Never Buy These Things From a Car Dealer—Or Pay For Them When You Purchase a Car

It’s no wonder people hate buying a car. You go to a car dealer, find the car you want and start the process to buy it. Then, you’re shown to windowless room where you’re made an offer.

There’s great news! The car dealer will give you a great value for your trade-in AND incentives and discounts. It adds up to thousands of dollars, maybe even 10% or more off the price.

And then…somehow it all piles back on and quickly, your purchase price is more than the MSRP, even with your trade-in factored in.

How is that even possible?

Video: How to configure a new car and know what you’re getting

This story is 100% human researched and written based on actual first-person knowledge, extensive experience and expertise on the subject of cars and trucks.

Understand the “Out the Door” Price Before Deciding To Buy

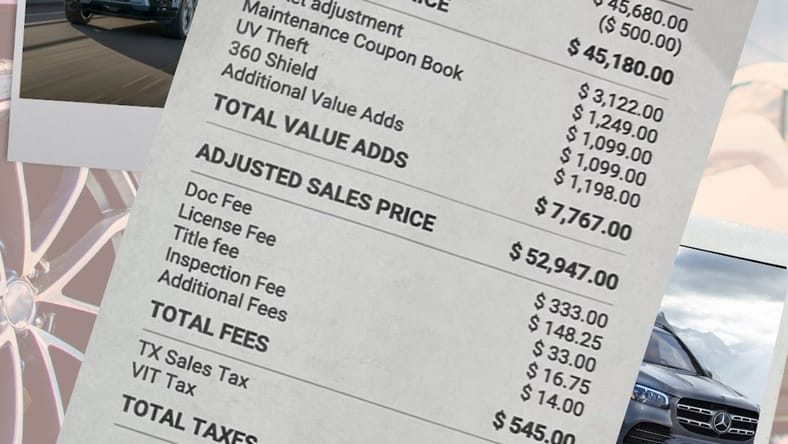

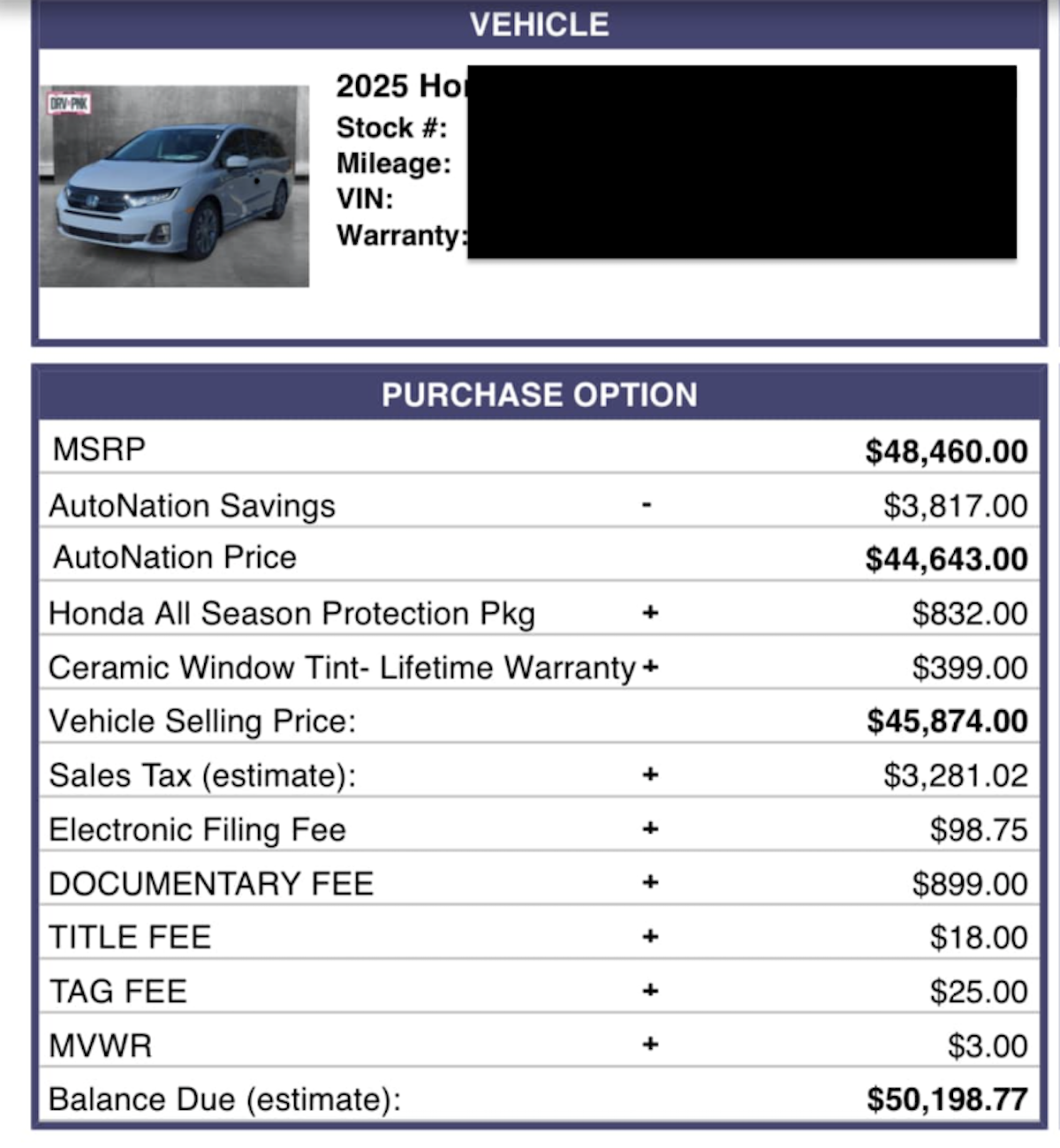

It’s become the standard procedure: Ask the dealer for the “out the door price” and you’ll get an itemized list of costs and credits. Costs include the purchase price, taxes, fees and cash back, trade-in and any other discounts.

This used to be the most fair and transparent way to understand your purchase, but, alas, car dealers have figured out how to bury extra costs in the OTD price, and often, gallingly, even highlight unnecessary extras right there on the form. So even if you get the OTD in writing, you need to pick apart every line and do your own math: What’s included and does it all add up to a fair price?

Here are the 11 Things You Should Never Pay a Car Dealer For.

Read: Ever Wonder How Car Dealers Make Money?

“Market Adjustment” is Just Another Name for Price Gouging

This one is just outrageous. A new car dealer gets in a popular model and has a waitlist for it with dozens of names. It quickly becomes an auction: Who is willing pay more than the MSRP for the car?

Our advice: Walk away and start calling other car dealers. For the $3,000 on this offer you can likely get this car from another dealer at MSRP or even have it shipped from out of state and still pay less. The other flag? If the dealer is willing to extort you like this, can you trust their service department or anything else on the offer sheet?

Read: Is Your Car Lease Up? Don’t Lease Another Car. Buy The One You’re Leasing Now

Extended Warranties are a Common Ripoff

These are tricky and can be designed to simply separate you from your money. First, if your car has a warranty, don’t buy an extended warranty. Then, dealer-offered warranties can often only be good at that car dealer and even if they are good nationwide, may not transfer with the sale of the car, so if you sell it, you eat the cost. Extended warranties often don’t cover the things that are the most expensive, or have criteria that phases out over time.

If you decide you do need an extended warranty, you can always buy it after purchase — but do it before the manufacturer’s warranty expires; that’s when the window closes on eligibility.

When are extended warranties a good idea? When buying a car with known issues, a reputation for unreliability or a used car that will be a financial burden to repair. And even then, read the fine print very carefully and make sure that you’re covered when big things go wrong.

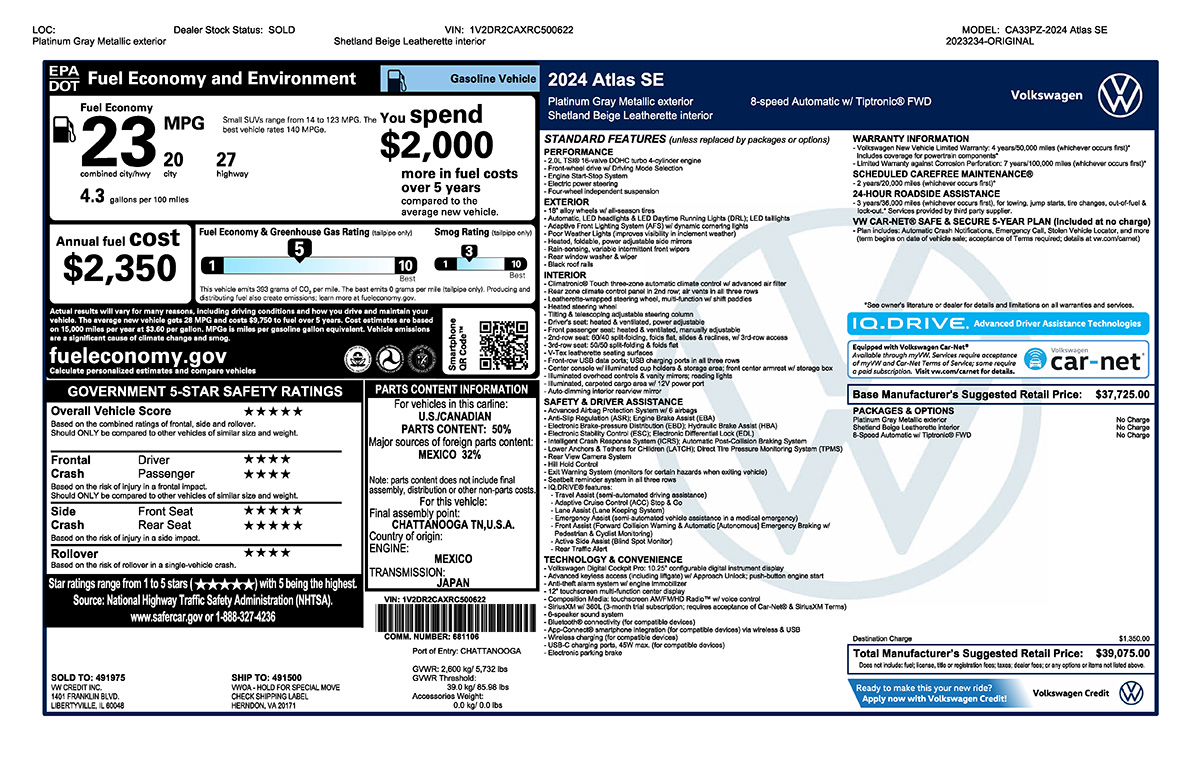

Read: How to Decode a New Car’s Window Sticker: What You Need to Know

All Season, Paint, Window, Upholstery or Wheel/Tire Protection

Oh, all the protections! Paint, underbody, wheels, tires, windows. Yes, your car dealer can offer these things and may even give you a fair price. But do you really need them? Protection against dings or cracks in your windshield is probably included for free in your car insurance policy—it’s a requirement in many states.

Do you really need wheel repair coverage? Or tire protection, which is probably also covered by the tire manufacturer? Say no to it all; if you decide there’s something you really want or need, shop around and if the car dealer has the best offer, buy it later.

Read More: Get ‘Em While You Can! 15 New Cars That Are Easiest to Negotiate at the Dealership

UV or VIN/Window Etching Might Be the Car World’s Oldest Graft

Designed to protect your car from theft, the real theft here is a car dealer trying to get you to pay for this. “Before I steal this car let me look to see if the VIN is etched on the window,” so no car thief, ever. Most cars are web-connected and can be located quickly if they’re stolen. Others are disassembled, disarmed, dumped or crashed before you can even file a police report. Your best defense against theft? A good insurance policy (and don’t leave the keys in the car).

Leave Gap Insurance or Other Coverage to Insurance Professionals

It’s a scary thought for sure: What if your car is totaled in the first couple of years while you still owe more than it’s worth? That’s the purpose of gap insurance— to pay the full cost of the car, not the value of the asset at the time of the crash. If you’re worried about this, or have a loan or lease that requires it, talk to your insurance provider and bundle this into your policy.

Car dealers love to sell gap insurance, as well as credit protection, which will pay off the car in instance of death or disability. But there’s another term for this: Life insurance. If you’re worried, get a policy that will cover your car as well as your other obligations and provide relief for your loved ones.

Window Tint? Great. As a Car Dealer Upcharge? Not So Much

If you live someplace where window tint is a good thing to have, shop around for the best price. Typically car dealers don’t offer the best price, but if they do, it may be worth buying it from them. Ideally, separate the purchase from your loan; you don’t need to pay 7% interest on a $500 window tint for 5 years, do you?

A Maintenance Package Is Just an Invitation To Spend More

This one is pretty outrageous. Many (many, many) new cars come with a few years of maintenance included, and its an easy add-on because other than oil changes, there’s not much to maintain for the first 50,000 miles, and no big equipment replacement requirements until you hit 100,000 miles.

So that maintenance package (for $1,249!) gives you pricey oil changes and maybe a few other things that you’ll likely pay 30% less for at a mechanic or specialty shop. And again, do you really need to finance that package over the life of the loan at 7%? That’s an extra $341 for the privilege of buying something you don’t need and is more expensive than it should be.

VIT Tax— Vehicle Inventory Tax

Here’s a nervy tactic: pass along the tax the dealer is charged by the city or state for the inventory on their lot. Yes, it’s probably not fair for the government to do this, but its the dealer’s cost of doing business, not your obligation. Just say no.

Excessive Documentation Fees Can Be an Abyss of Confusion

It’s important to understand what is included in “doc fees,” which can range from a few hundred dollars to more than $1,000. It’s helpful to know that CarMax charges a flat $200 for doc fees, which includes all the forms they have to fill out in order to process your sale.

If the doc fee seems high, get a fully detailed description of what is included in that; there may be other things dumped into the doc fee as an explanation. Those should be listed, and considered, separately.

We get it, it takes time that extends to the filing process after your sale is completed. It’s OK. The dealer knows what they are doing and have people who do this. But it’s not OK for them to think their time is worth a lawyer’s hourly rate. It’s not.

Excessive License and Registration Fees Can Be Another Rip-Off

It’s a nice service that dealers offer: To register your car for you and put your license plates in the mail. After all, a trip to the division of motor vehicles is never a joy. Ever.

However, you don’t need to pay for that pain, just for the fees. Again, dealers have a process to register your car and send your license plates and it should be part of the service, not an upcharge. Your state’s DMV lists all the fees, so know what they are before you pay the dealer for this.

Delivery Fees Are Already Included; Don’t Pay This Twice

This is a slight of hand that many dealers delight in: Adding the destination charge or delivery fee to your OTD offer. But it’s already included in the MSRP or purchase price which is listed on the Monroney window sticker. If you see ‘delivery’ listed on your purchase offer, have it removed, or better yet, remove yourself from that dealership.

Included Equipment Should Be Just That: Included

A beautiful sunroof! Roof rails! All terrain tires! Floor mats! A rear seat entertainment system! It all sounds so good and of course you want these things. But double check the Monroney window sticker. If it’s already included in the price it shouldn’t be included in the itemized list on the offer. Though it may be because, “oh, sorry! That was a mistake!”

There are always lots of “mistakes” and misprints on purchase offers. Opaque line items that need full explanation are common, as is fuzzy math that does’t add up. Yes, it’s a lot to think about, so take your written offer home and dissect it over a strong cup of coffee in the daylight when your head is clear. Don’t pay for things you don’t need and don’t finance things that you won’t need for a while or that can buy at a better price from someone else, like your insurance company or a window tint specialist.

And if you feel like you’re being taken advantage of, find another dealer. The good news is that no car is unique, there are 17,000 new car dealers in this country and that car you want is out there being sold by someone who wants your business, not to hoodwink you into being ripped off.

More About:Car Buying